No products in the cart.

Bookkeeping

How are FICO Scores Calculated?

We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. The two most common types of credit accounts are revolving and installment credit. Both can have an impact your credit score, however their borrowing and payment structures differ.

You’re our first priority.Every time.

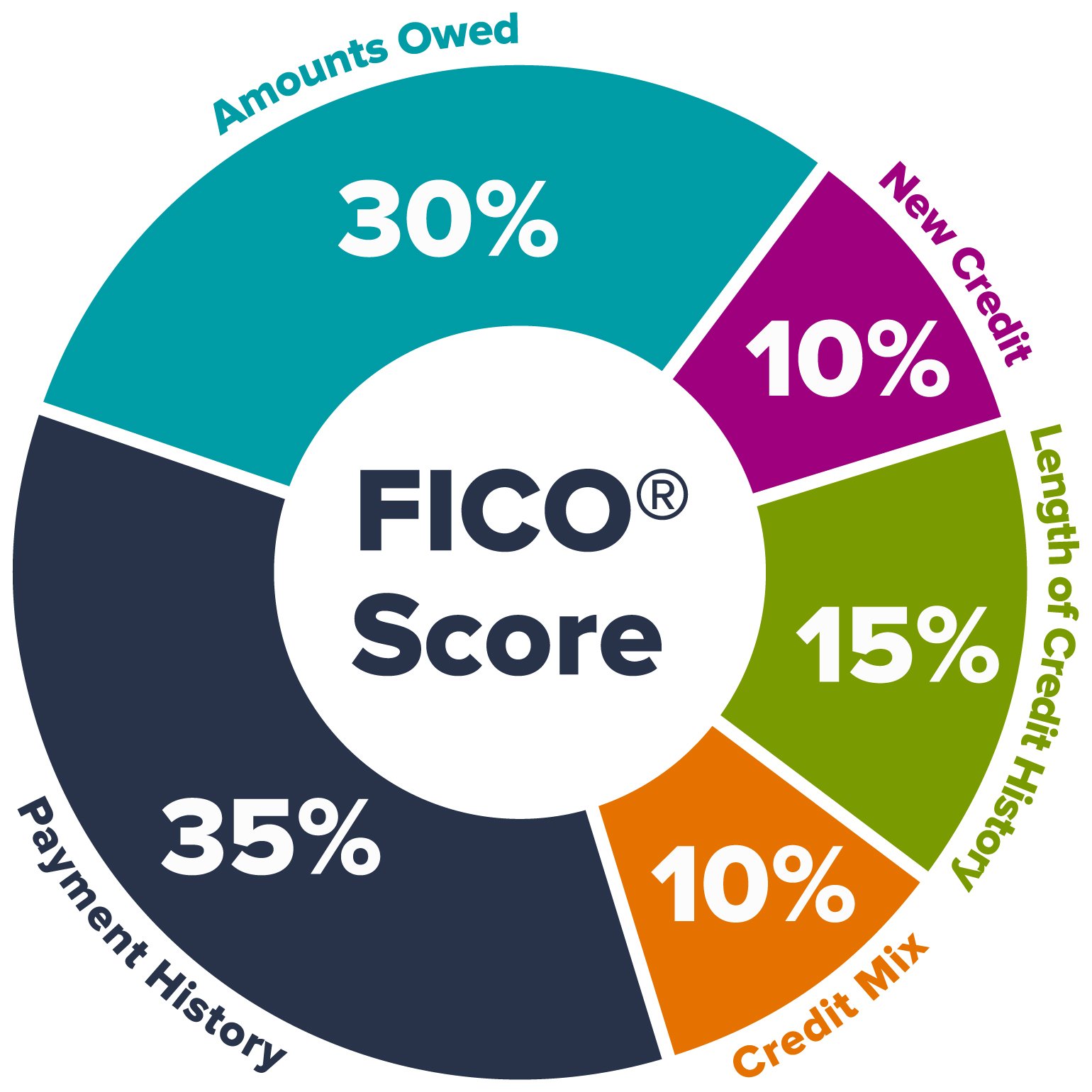

If you are having trouble getting approved, you can always look into secured credit cards, income-based credit products, or credit building debit cards. Having a thin credit profile will likely mean that you won’t qualify for some credit cards. So instead, you’ll need to do some research to find a credit card that you are likely to be approved for before you apply. While FICO closely guards their proprietary algorithms for credit score calculations, they do give us a few hints on how the different credit management factors influence our credit scores. Your FICO credit score is built upon five main factors, and your credit mix is one of them. The Credit Mix portion of your score is a measure of your creditworthiness based on the types of credit lines you have open.

Survey finds that people are not as financially literate…

Then, if you can shoulder new debt, consider applying for different accounts to diversify your credit mix and potentially boost your credit score. Installment credit, or non-revolving credit, is a type of credit that has a fixed end date and fixed payments every month until you pay off the full balance. Typically, you borrow a sum of money and repay it over a set amount of time. If your loan has a fixed interest rate, your payments will be the same each month. However avoid applying for loans or credit cards that you don’t need just to improve the credit mix component of your credit score.

Credit diversity makes up 10% of your FICO score. So, what is it?

- Credit utilization reflects the amount you owe, which has a more substantial impact on your credit score than your credit mix.

- Credit repair companies often offer to help improve your credit score by working on your report, but the truth is, paying down your debt is a more effective strategy.

- We may also receive compensation if you click on certain links posted on our site.

- Although the inquiry stays on your report for two years, FICO only considers inquiries from the past 12 months.

- Learn about how having a better credit mix can take your score from good to excellent.

This could be a student loan, auto loan, mortgage, personal loan, or credit-builder loan. If you borrowed a specific amount and you’re paying in monthly installments, it’s an installment loan. While credit mix only accounts for a modest portion of your credit score, it’s important to understand. Here’s how a good mix of credit cards and loans in your credit report can help your score. Bankrate.com is an independent, advertising-supported publisher and comparison service.

Is it worth a drop in your score to apply for a small loan to show creditors you can manage payments successfully? With credit mix being such a small percentage of your credit score, the answer is, “probably not.” However, in the end, the final decision is yours. Understanding credit mix and the role it plays in your credit scores is important if you’re trying to maintain your credit or improve your credit scores. And monitoring your credit can help you see exactly where you stand—as well as how much progress you’ve made. CreditWise gives you access to your free TransUnion® credit report and VantageScore 3.0 credit score anytime.

Our expert guide provides actionable tips to improve your creditworthiness and unlock better financial opportunities. Lenders like to see a variety of credit because it shows that a borrower how does credit mix affect credit score has experience managing different credit accounts. This indicates that the borrower has diverse financial obligations and has demonstrated the ability to manage them responsibly.

Your credit mix is a fairly small part of your credit score, so not having a perfect credit mix likely won’t affect whether a lender will approve a loan for you. Broadly speaking, it measures how well-diversified your credit profile is. Demonstrating that you can responsibly manage different types of credit can indicate that you’re a reliable borrower.

Keep in mind that your credit mix may be one of the smaller factors in credit score calculations, depending on the credit scoring model used. A personal installment loan can also help you twice if you move high interest credit card debt to a personal loan. You’ll lower your utilization rate (installment loans are expected to have a high balance) while improving your mix. Making regular monthly payments to “pay back” your loan will serve to put a check in the installment credit box on your credit reports. Your credit mix is the combination of the credit accounts—like mortgages or credit cards—listed on your credit reports. This can include revolving credit, like credit cards, and installment credit, like car loans and mortgages.

However, if your credit card has a $5,000 limit, there is no deadline on when you have to pay it back. You only have a monthly minimum payment which usually covers interest rates or APR. Also, keep in mind credit mix is only a small fraction of your score.

👉 The balance between these types of accounts defines your credit mix. EDITORIAL DISCLOSURE All reviews are prepared by CreditCards.com staff. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review.